The transition to net-zero is no longer a strategic horizon. It is a delivery agenda. Electrification is accelerating across all sectors: mobility, heating, industry, and digital infrastructure. This is driving a steep and sustained increase in demand for electricity and process heat. At the same time, security of supply, cost volatility, and carbon constraints are pushing system operators and industrial players to reassess their options.

Renewables are central to the energy transition but their variability limits their ability to guarantee stability. What is needed is also reliable, dispatchable, low-carbon generation capacity; scalable across geographies, compatible with grid constraints, and usable beyond electricity. This is where Small Modular Reactors (SMRs) enter the equation.

SMRs offer a different proposition from legacy nuclear assets: lower unit sizes, modular design, and hopefully faster deployment potential. They can co-locate with industrial platforms, for some deliver both power and heat, and enable resilience at local scale.

But the challenge is clear: SMRs will not scale by virtue of promise. They will scale only if delivered faster, cheaper, more predictably than past projects. That requires rethinking operating and delivery models.

1. Electricity demand rises sharply: Europe will need 75,000 TWh annually by 2050, with as little carbon emissions as possible

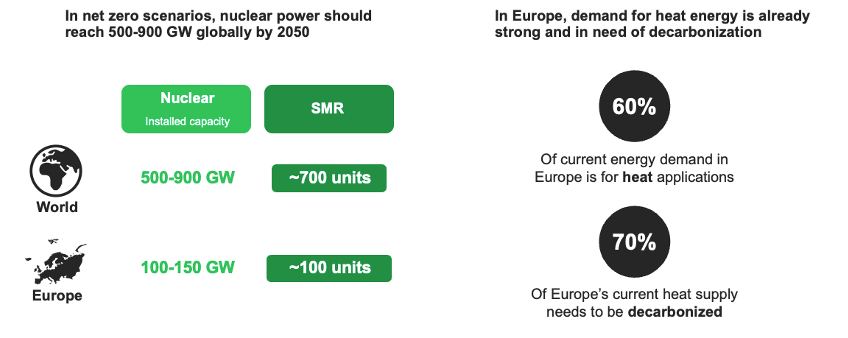

By 2050, global electricity demand is projected to exceed 75,000 TWh per year – roughly seven times today’s levels. This growth is structural, driven by the electrification of transport, the scaling of digital services, and the decarbonization of industrial processes.

In parallel, the need for clean heat is intensifying. In Europe alone, decarbonized heat demand could reach 500 to 1,000 TWh by mid-century. Current technologies do not fully address this gap – especially for high-temperature heat or continuous loads.

New energy customers are emerging – data centers, hydrogen producers, and industrial hubs – each with unique profiles: constant demand, low tolerance for volatility, and growing ESG exposure. These actors are not looking for traditional grid power. They need local, low-carbon, and firm energy solutions. SMRs can serve this need with high flexibility: compact footprints, co-generation capability, and potential integration within or near industrial platforms.

2. Commissioning times for nuclear energy call for new approaches: enter the SMR

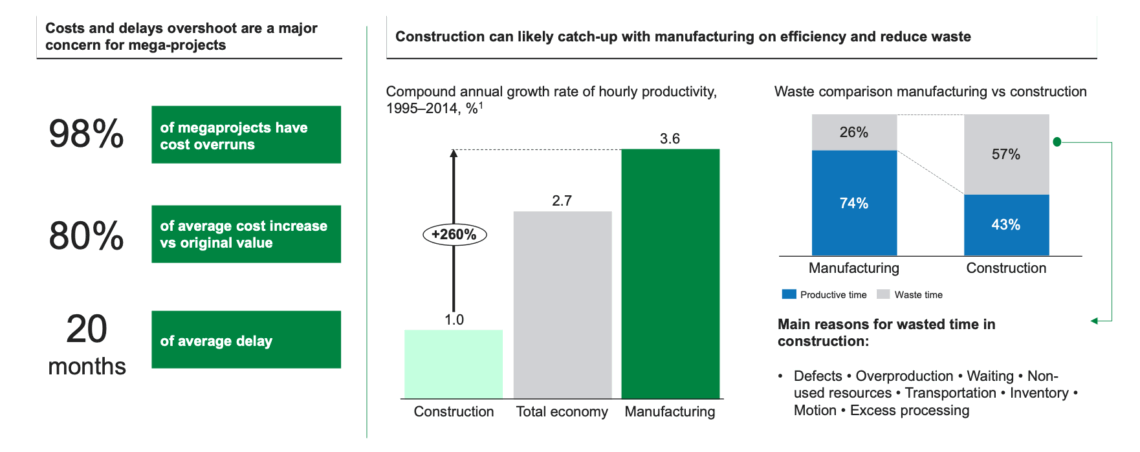

Large nuclear projects have repeatedly struggled to meet time and cost targets. Multiple programs have demonstrated the same structural issues: long lead times, supply chain fragmentation, and regulatory uncertainty.

SMRs offer an alternative model. Designs like Rolls-Royce’s SMR, the BWRX-300 (GE Hitachi), or Nuward (EDF) – typically in the 300-500 MW range – as well as Gen IV reactors with passive safety systems and advanced fuels, are built around modularization, standardization, and replicability. Modularity (and by extension, prefabrication) draws from industries already mature in that respect: Oil&Gas (e.g. oil rigs), Chemical plants, conventional power (e.g. HVDC converters for offshore wind) , naval construction or aerospace.

Rather than being bespoke projects, SMRs aim to function as configurable systems – assembled from pre-fabricated modules, with shortened construction cycles and reduced site risk. This model aligns with evolving market expectations: faster returns, lower upfront capex, and higher predictability.

3. Successfully delivering an SMR requires a rethinking of the entire value chain

The deployment of SMRs cannot follow legacy patterns. The model must shift from bespoke, monolithic project execution to industrialized, modular delivery.

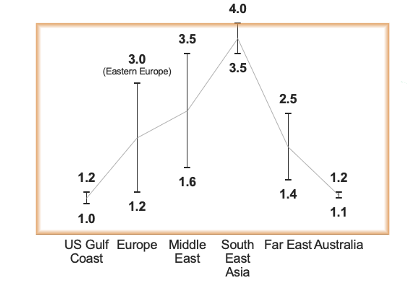

There are clear benefits in modularizing. Experience from comparable sectors shows that modularization – at 50% or more of the total scope of the SMR – can yield up to 30% shorter time-to-market and 40% cost savings. In the nuclear field, where interface complexity is high and compliance requirements are high, these gains may be greater. Productivity can be multiplied by 1.2 to 4x, depending on the location where the module is produced.

However, this value does not emerge automatically. About 2/3 could reside upstream: in early-phase design integration, interface simplification, and system-level coordination. It must overcome a complex and unstable value chain (low supplier retention and limited batch sizes, supply discontinuity between units due to long-cycle projects, IP sharing and governance between partners), high complexity of delivery model and on-site construction and cross-national deployment under different regulatory regimes.

Large scopes can be modularized, yet increasing the complexity of sourcing. Some programs aim for hundreds, up to 1000 modules and 70-80% modularity. It increases logistical complexity. Yet experts believe that ~90% of modules are not critical from a nuclear safety point of view. Modules have to be double sourced, with a limited number of Tier 1 suppliers to minimize interfaces

There are higher upfront costs, and specific multi-functional teams and digital tools to put in place.

To unlock the value of modular delivery, three strategic choices must be addressed early:

- Define the role and scope of the main/lead EPCC/M partners. This includes identifying construction and civil works partners capable of supporting a program and multi-site deployments, either directly or through localized models.

- Define and segment modules. Complex, core modules require different sourcing strategies than simpler units. Each should be assessed through a make-or-buy lens – design, fabrication, and integration decisions must balance control, cost, and risk. A parallel choice involves process integration: centralizing systems into a single building or distributing across structures, with lessons from past projects favoring pre-integration and prefabrication.

- Choose who delivers conventional systems designs. Functions like turbine halls, heat sinks, and balance-of-plant integration can be retained in-house, managed through EPCM, or outsourced. These decisions affect partner strategy, interface numbers and delivery risk. They must be decided early.

These are not minor adjustments. They shape the entire delivery model.

To enable this shift, the value chain must be restructured. Procurement must move earlier. Partners must be engaged sooner. Design must be driven by modularity constraints, not retrofitted to them. Interfaces – technical, organizational, and contractual – must be explicitly identified and minimized. Logistics and assembly must be treated as core project risks. We see successful projects relying on one partner orchestrating logistics.

This also requires specific capabilities. Owners need modular competence – teams that understand systems engineering, interface management, and schedule integration and are able to challenge or complement engineering partners. Without this, modular programs can underperform. Multi-functional teams, aligned across engineering, operations, licensing, and logistics, are non-negotiable.

Digital continuity is a further enabler. Leading SMR programs are deploying end-to-end Product Lifecycle Management (PLM) tools, ensuring version control, traceability, and coordination across distributed partners. Without this, complexity can become unmanageable.

4. Delivering SMRs demands more than good design; it requires a tailored delivery model

To go from high potential to actual delivery, SMRs must be delivered with a new set of rules. Traditional nuclear delivery model, adapted to large one-off projects, are incompatible with the agility and the cost profile that today’s energy landscape demands.

Five imperatives must guide successful SMR programs:

- Simplify the design : reduce the number of parts, interfaces, and variants to improve constructability and accelerate validation.

- Ensure modularity is real: design for optimal fabrication, transportability and assembly

- Maintain control over the EPPC cycle: secure dedicated, internal capabilities in Engineering, Procurement, Project Management, and Commissioning from day one.

- Function as an extended enterprise: build governance and execution frameworks that integrate partners from design to commissioning.

- Adopt a digital approach: ensure PLM continuity across the full lifecycle to manage complexity, versions, and accountability.

The opportunity for SMRs is now. But quality of design and excellence in program and project execution will determine who comes out on top.

At Do Well Do Good, we work with SMR developers and ecosystem partners to operationalize these principles. We assist them in developing their mid-term plans at conceptual and basic design stages. That includes partnership and supply chain strategy as well as client identification & qualification and go-to-market strategies.