Electrical or Electronic Equipment (EEE) has drastically changed our daily lives over the past 50 years. According to a survey conducted in 2022 on close to 9,000 european households in 6 countries, the average European household now owns 74 such items, including 9 that are still working but not being used anymore, and 4 that are broken [1].

As it turns out, Europeans are big hoarders of e-products. Still, many are tossed every year. Actually, e-waste, or Waste of Electrical or Electronic Equipment (WEEE), is the fastest growing domestic waste stream in the world, growing at 3% annually for an annual world population growth that dropped below 1% in 2021.

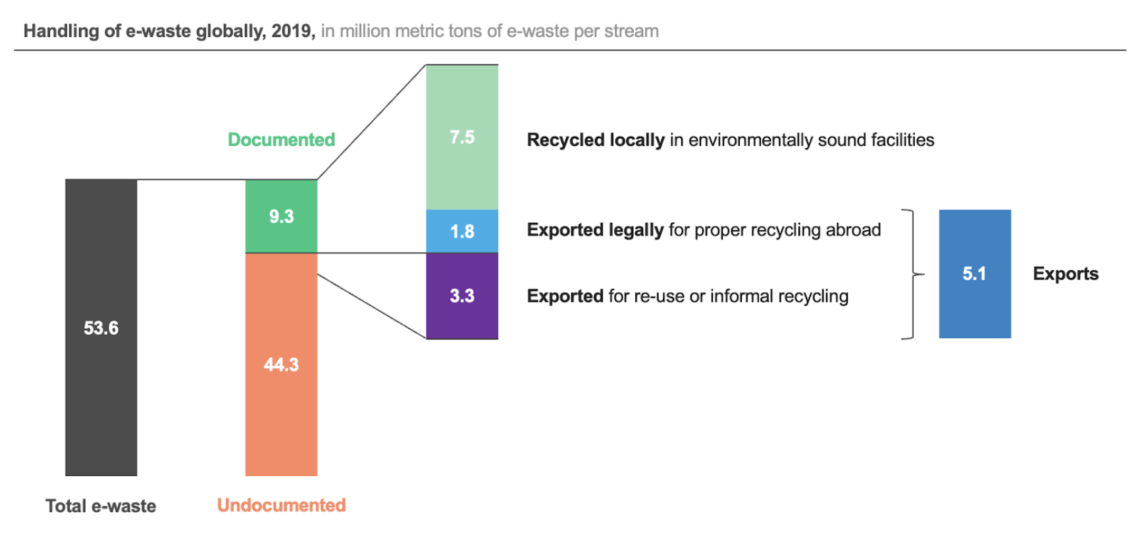

Comprehensive statistics on e-waste are regularly collected and analyzed as part of the e-waste monitor, an initiative of UNITAR, the UN University and International Telecommunication Union. In the latest issue of the Global e-waste Monitor, published in 2020, they estimated that the world generated 53.6M tons of e-waste in 2019, from 44.4M tons in 2014, and global generation of e-waste is projected to reach 74.7M tons by 2030 [2].

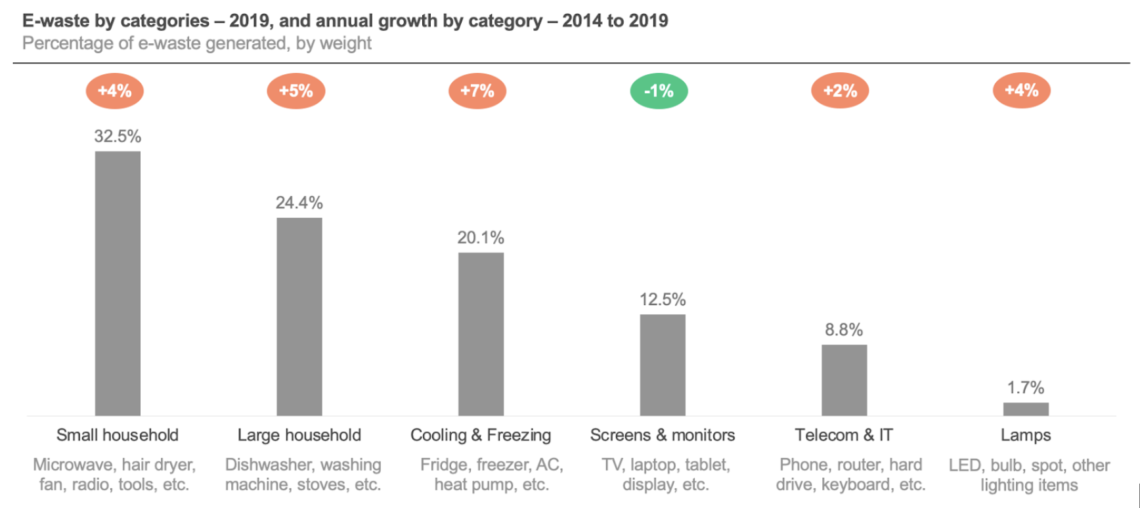

Among e-waste, the report distinguishes 5 categories; small household appliances and tools is the largest by weight, while cooling and freezing equipment is the fastest growing category, at 7% per year. Quantities of small household appliances and mobile phones discarded each year may be slowed down by the tendency of Westerners to hoard, as demonstrated by the survey quoted above, in which these items were declared to be the most often kept at home even when they are not used or don’t work anymore. Screens and monitors have decreased by weight, as a result of big monitors being replaced by flat panel displays which are lighter, but the number of discarded items still grew during the observation period.

While it seems that the growth of global e-waste generation will slow down slightly, at 3% per year until 2030 vs. 4% per year between 2014 and 2019, such volumes already represent a challenge, as evidenced by data on the fate of these items. Indeed, a mere 17.4% of this waste is documented to be properly collected and recycled, while the rest is either disposed of in informal ways and ends up in landfills, or gets trashed in regular municipal bins, and ends up incinerated in most cases. Part of it is also exported illegally, mainly to developing countries.

Handling of e-waste varies a lot per geography; Europe has the highest formal e-waste collection rate of all continents, around 42.5%, but it is also the largest generator of e-waste per capita, with an estimated 16.2 kg of e-waste per person in 2019. In comparison, that same year, Asia and Africa generated 5.6 kg and 2.5 kg of e-waste per capita respectively.

Uncontrolled exports of e-waste within or outside the European Union represented 1.3M tons in 2019, of which only 2 -17k tons were seized as illegal exports [3]. Exportations from Western Europe usually go East, but also towards West Africa, where their exportation is illegal; to bypass regulation, companies label them as “used EEE”. Of course, some of these products actually work, or can be repaired – in which case they are, as West Africa is doing really well at giving a new life to old electronics that the West doesn’t bother repairing. Sadly, a majority of this e-waste will remain just waste and ultimately end up on dumps such as the infamous Agbogbloshie (now evacuated and demolished by the government of Ghana). This dump received extensive press coverage in the past years for the dreadful work conditions of its “burners”, who are burning cables and other electronics to extract and resell the metals they contain, and the contamination of land and air in which its whole population lived.

Be it in Africa, China, Pakistan, India or in the West, informal disposal or recycling of e-waste is creating serious negative externalities, for the planet and for human health. Many electric or electronic devices contain hazardous substances, including heavy metals (lead, mercury, cadmium), chemicals like refrigerants, which cause important damages to the ozone layer, and flame retardants which release dioxins and furans when burning.

Exportations are still widespread despite being illegal for a very simple reason: many times, it is cheaper to export than to handle e-waste domestically. According to research published in 2018 by the European Commission and UN University, compliant treatment of electric and electronic products can range from 120€ per ton for large household appliances to 280€ per ton for a TV, with depollution accounting for 50% of the cost, and reporting & audit for another 20%. Profitability of the operation will depend on the value that the firm expects to recover from each category of items.

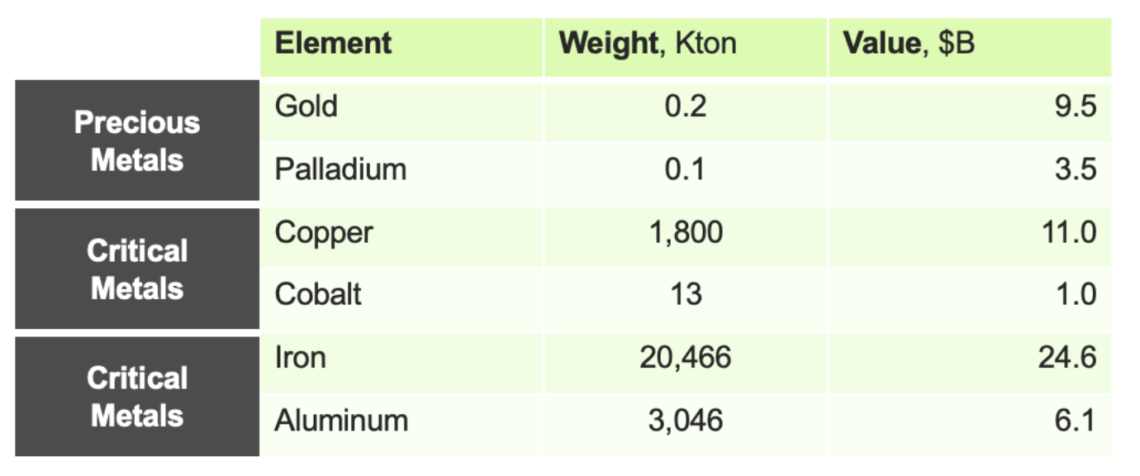

Raw materials contained in global e-waste generated in 2019 were evaluated at $57B, based on the estimated concentration of 16 elements out of the 69 contained in WEEE.

Largest contributors of this bonanza were iron, copper, gold and aluminum, but other precious or critical metals can be recovered from EEE, most of them semiconductors lying on the Printed Circuit Boards (PCB) of the objects considered.

This “detail” may explain why a large part of this potential is still untapped; very few companies are able to properly extract metals from PCB. In Europe, only a few players are able to handle them. Giant refiners Umicore (Belgium), Boliden (Sweden) and Aurubis (Germany) are the largest ones; e-waste constitutes so far only a marginal part of the feedstock they process for producing new raw materials. Post-industrial scrap, which is much easier to handle, remains their main source of non-virgin metals. Beyond Europe, refiners in Canada, South Korea and Japan also have sizeable capacity and likely operate in the same way.

Recently, pure players have entered this business with an innovative approach. In the north of France, Igneo Technologies and Weeecycling are exponents of a new generation of refiners which focus on metal recovery, with a customized furnace technology. Both use mainly PCBs as feedstock, but they have adopted different strategies.

Weecycling was created in 2019 as a subsidiary of Morphosis, a SMB dismantling WEEE to re-sell materials and components to specialized businesses. When they figured out that very few companies were candidates to treat the PCBs they extracted from electronics, they decided to do it themselves. Today, Weecycling has 130 employees and an annual capacity of 10,000 tons of e-scrap, and has expansion plans [5]. They claim to be the only company in the world producing pure metals using 100% post-consumer scrap, which they sell at the same price as virgin metals to high-tech and specialized industries such as semiconductors and pharmaceutical companies.

Igneo Technologies, founded in 2008, does not refine the metals; it is focusing on eliminating plastics, resins and other undesirable components from the PCBs, to produce a concentrate of copper and precious metals, which they sell to smelters. Having reached a capacity of 30,000 tons per year in their first plant in France, they are now developing at scale in the US, with 4 plants planned for a combined capacity of 180,000 tons of e-waste, using funds injected by Korea Zinc, which took a 73% stake in the company in 2022 for $330M [6].

E-waste management market was valued at $50B by Allied Market Research for the year 2020, with a forecasted CAGR of 14.3% through 2028, translating into $145B by then. Key opportunities were clearly identified by newcomers to this market; but to make a real impact, the change and innovation will need to cover the entire value chain.

Eco-design is a prerequisite to enable more circularity at each step of the lifecycle of the products, starting from the expansion of their lifetime. Today, for instance, the average lifetime of a smartphone is 3 years, and it seems like most manufacturers are doing all they can to prevent people from repairing them, when they do not outright design them to stop working after a given amount of time – the so-called “planned obsolescence”. Companies like Fairphone have tried to change the paradigm, introducing products that are modular and where building blocks are easy to replace without altering the rest of the device. Eco-design can also facilitate recycling, when the product really reaches its end-of-life. Infineon, Germany’s largest semiconductor manufacturer, announced in July that they teamed up with British startup Jiva Materials to use plant-based PCB material for their demo and evaluation boards. Soluboard dissolves when immersed in hot water, allowing the electronic components soldered to the board to be recovered and recycled [7].

Regulation also plays a critical role in the structuration of the value chain, especially at the recollection step. In the EU, retailers are required to take back the old electronic products of clients purchasing a new one, and manufacturers are responsible for handling end-of-life of the devices they build. In 2019, Singapore enacted similar regulation [8].

But this is not only about developed countries. Places where harmful informal recycling practices still prevail need investment to set up facilities for dismantling equipment and for recovering certain metals under safe conditions. An investment of 76k€ from the Global Green Growth Institute was recently announced to build an electronic waste recycling center in Senegal [9]. This is great news, but still a drop in the ocean.

In the meantime, corporations who want to contribute to the clean and safe recycling of smartphones in emerging countries can use the waste compensation service Closing the Loop, which compensates each new device purchased by a company with the collection and recycling of a smartphone in a place where they are usually not handled properly.

Sources

- International e-waste day, WEEE forum, october 2022

- Global e-waste monitor 2020, UNITAR, July 2020

- Global transboundary e-waste flows monitor 2022, UNITAR, June 2022

- WEEE Recycling Economics – The shortcomings of the current business model, UN University and European Commission, January 2018

- En Normandie, économie circulaire et politique RSE font bon ménage, Libération, May 2023

- Korea Zinc invests in Igneo Technologies, Recycling Today, July 2022

- Infineon uses recyclable PCBs from Jiva Materials to minimize electronic waste and carbon footprint of demo and evaluation boards, Infineon official website, July 2023

- Singapore’s government teams up with grassroots to tackle e-waste, KrAsia, September 2023

- Senegal: GGGI equips Sandiara with an electronic waste recycling centre, Afrik 21, July 2023