1. What is the CSRD?

In recent years, the global corporate landscape has been undergoing a significant transformation towards sustainability and responsible business practices. Companies are increasingly recognizing the importance of integrating environmental, social, and governance (ESG) factors into their operations and reporting. In this context, the European Union has taken a pioneering step towards fostering sustainability by introducing the Corporate Sustainability Reporting Directive (CSRD). This directive, with its focus on double materiality assessment, European Sustainability Reporting Standards (ESRSs), and the EU taxonomy, represents a major leap towards greater corporate transparency and accountability.

The CSRD is an extension of the previous NFRD (Non-Financial Reporting Directive), adopted in 2014 by the EU. Where the NFRD covers approximately 12’000 companies, the CSRD is expected to increase this number to 50’000 companies.

- The CSRD redefines corporate reporting by introducing the double materiality assessment. In addition to financial impacts (financial materiality), businesses will now have to report their impact on people and environment (impact materiality) beyond most existing frameworks.

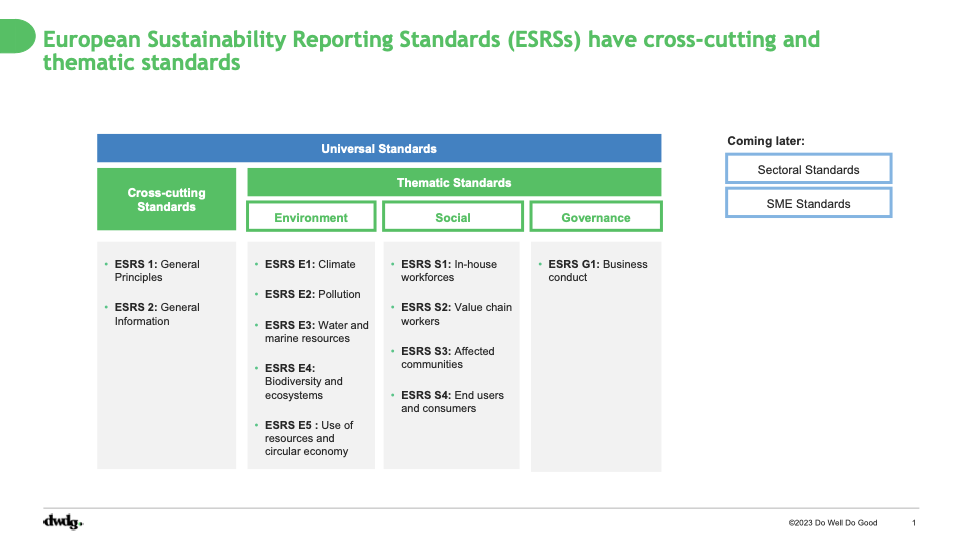

- This transformation within the CSRD landscape is driven by the European Sustainability Reporting Standards (ESRSs). These standards will provide a harmonized framework for reporting on a wide range of ESG topics, ensuring that companies disclose consistent and comparable information.

- The CSRD also introduces EU taxonomy. It provides a classification system that defines which economic activities can be considered environmentally sustainable.

2. What are the requirements within the scope of the CSRD?

2.a. Double Materiality Assessment

One of the central pillars of the CSRD is the adoption of a double materiality assessment. This means that companies will not only report on the financial implications of ESG factors but also assess the impact of their activities on the environment and society. This approach recognizes that sustainability issues can affect a company’s financial performance, and conversely, a company’s actions can have a significant impact on society and the environment.

By embracing double materiality, the CSRD encourages companies to go beyond mere compliance and take a more proactive approach to sustainability. It compels them to consider not only the risks they face due to ESG factors but also their role in mitigating these risks on a larger scale.

2.b. European Sustainability Reporting Standards (ESRSs)

To standardize sustainability reporting across the EU, the CSRD mandates the use of European Sustainability Reporting Standards (ESRSs). These standards will provide a harmonized framework for reporting on a wide range of ESG topics, ensuring that companies disclose consistent and comparable information. The adoption of ESRSs is a significant step towards transparency and allows investors, regulators, and the public to make informed decisions based on reliable data.

To name a few, the CSRD requires companies to report on:

- GHG emissions

- Water usage

- Waste and recycling rates

- Working conditions and human rights

- Governance and accountability

2.c. EU Taxonomy

The EU taxonomy is another vital component of the CSRD. It provides a classification system that defines which economic activities can be considered environmentally sustainable. It sets standard assessment criteria, across various sectors and industries, to determine what universally qualifies as “sustainable”. It guides investors, financial institutions, or private companies, in making green investment decisions.

The taxonomy provides a classification system that is used by both the CSRD and the Sustainable Finance Disclosure Regulation (SFDR), the latter being another EU regulation that complements the CSRD. It requires financial market participants, such as investment firms and financial advisors, to disclose information about the environmental and social impact of their investment products.

2.d. Additional requirements

Apart from the aforementioned key features, the CSRD has additional objectives.

Targets and forward-looking information

A company’s sustainability targets are their short-, medium-, and long-term goals for improving their environmental and social performance. Companies should set sustainability targets that are ambitious, measurable, achievable, relevant, and time-bound. The methodology used to set targets should be transparent and based on robust data and analysis.

Companies should develop plans to improve their sustainability performance, such as investing in renewable energy, reducing water consumption, and sourcing materials from sustainable suppliers. In addition, companies should identify and seize opportunities, such as developing new products or services that are environmentally friendly or socially responsible.

Intangible assets

The CSRD recognizes the growing importance of intangible assets in driving business value. As a result, it requires companies to disclose information about their intangible assets, including:

- Human capital: The knowledge, skills, and experience of employees

- Intellectual capital: Patents, trademarks, copyrights, and other forms of intellectual property

- Social capital: Relationships with customers, suppliers, and other stakeholders

The aim of these requirements is to provide investors with a more comprehensive understanding of a company’s value. In the past, companies have often focused on disclosing financial assets, such as cash and property. However, intangible assets are becoming increasingly important in today’s economy. For example, a company with a strong brand may be able to command higher prices for its products.

Limited assurance

The CSRD introduces a requirement for companies to obtain limited assurance on their sustainability reports. This means that an independent auditor will need to examine the company’s sustainability reporting process and provide an opinion on whether the information is presented fairly and accurately. Limited assurance is a less stringent level of assurance than reasonable assurance, which is the current requirement for financial reporting.

It aims to improve the quality of sustainability reporting. In the past, there has been a lack of consistency and standardization in sustainability reporting, which has made it difficult for investors to compare the sustainability performance of different companies. Limited assurance will help to ensure that sustainability reports are more reliable and comparable, which will benefit investors, companies, and other stakeholders.

The CSRD’s limited assurance requirement is a significant step forward in terms of corporate sustainability reporting. It is expected to have a major impact on the way companies report on their sustainability performance and on the information that is available to investors and other stakeholders.

3. CSRD is an opportunity for your company to be a market leader on sustainability

3.a Who is targeted and what is the timeline?

The CSRD is primarily aimed at large and listed companies operating within the EU. However, its effects will ripple through the entire business ecosystem. Smaller companies, non-listed entities, investors, and stakeholders will all be influenced by the increased transparency and accountability brought about by the directive.

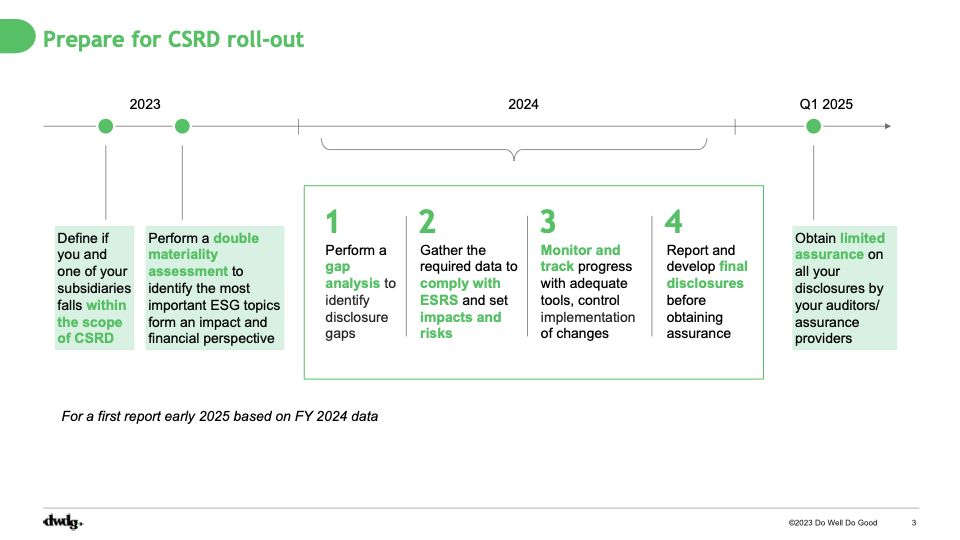

The CSRD is set to be phased in gradually. The European Commission has proposed a timeline where large and listed companies would need to comply with the directive from 2024 onwards. This phased approach allows businesses to adapt to the new reporting requirements and ensures a smoother transition towards sustainability reporting.

3.b CSRD requirements are overlapping with existing frameworks (eg…)

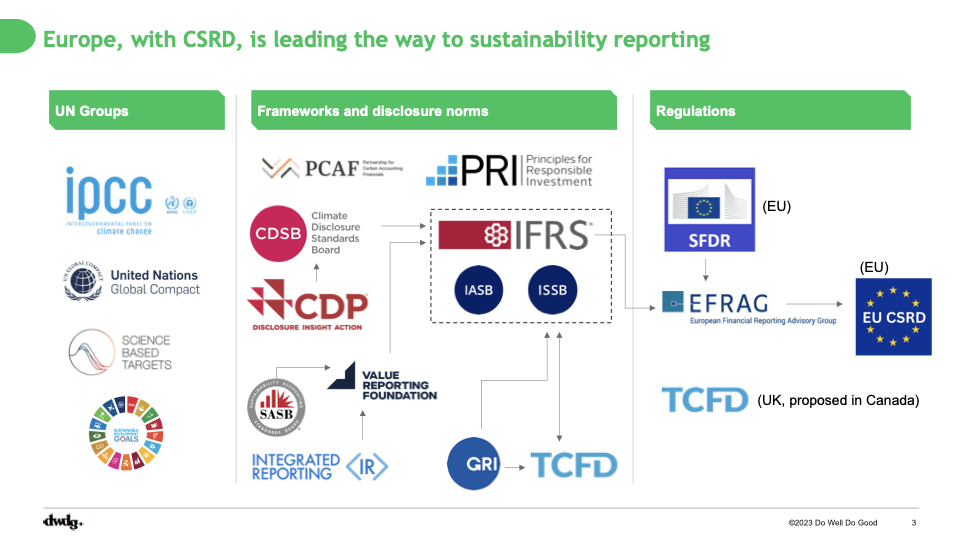

While the CSRD sets a high standard for sustainability reporting, it takes inspiration from many existing reporting frameworks, such as the Carbon Disclosure Project (CDP), the Task Force on Climate-related Financial Disclosures (TCFD), and others. We can classify these frameworks between United Nations initiatives, private ones, and additional regulatory frameworks.

We can also expect a convergence with financial reporting, even if Emmanuel Faber, president of the International Sustainability Standards Board (ISSB, part of IFRS), has recently criticized the CSRD and the concept of “double materiality”. Some of his claims are that impact materiality doesn’t interest investors, and that it is too complex to measure. However, most stakeholders agree to the fact that not every social or environmental impact can be financially measured, so they require to have their own materiality.

3.c Planning ahead helps you position yourselves at the forefront of sustainability

For companies falling under the scope of the CSRD, it is crucial to plan ahead. This involves understanding the reporting requirements, assessing the impact on existing reporting processes, and investing in systems and capabilities necessary for compliance. Simultaneously, it is vital to monitor the evolving regulatory landscape closely, as sustainability reporting standards and requirements may change over time.

Use the CSRD to demonstrate your company’s commitment to sustainability. By reporting on your company’s sustainability performance in a transparent and comprehensive way, you can show stakeholders that our company is serious about sustainability and you can build trust with them.

In addition, the CSRD is a helpful framework to identify areas for improvement. What are the biggest challenges? How can you address them? By tracking progress over time, you can see what is working and what is not, and you can make necessary adjustments.

Likewise, the CSRD helps you share your sustainability story to the world. What have you accomplished? What are you the most proud of? It is an opportunity to highlight your company’s achievements, to share your vision for the future, and to inspire others to follow suit.