The cement-concrete industry is a significant emitter of greenhouse gases.

It releases approximately 0.6 tonnes of CO2eq per tonne of cement produced, accounting for 7 to 8% of global emissions, which is more than triple the direct emissions of the aviation sector. Cement production, driven notably by demand from China and India, is increasing and is projected to rise by 12% to 23% by 2050. Concrete, which is derived from cement, is the second most consumed substance after water.

In the case of the Reference Technology Scenario by the International Energy Agency—a moderately ambitious scenario aiming for a global warming of 2.7°C by 2100, involving significant changes compared to “business as usual”—the increase in emissions would not be proportional to production growth, but it would not be zero (an additional 4% emissions if production increases by 12%).

Therefore, it is imperative to take action to decarbonize this industry, a goal recognized by stakeholders in France who are committed to decarbonizing their production sites. However, they face systemic transformations within their operations that complicate achieving the highly ambitious objective of reducing emissions by 90% by 2050 (see Fig. 3).

Current efforts in France appear to be focused on decarbonizing cement production.

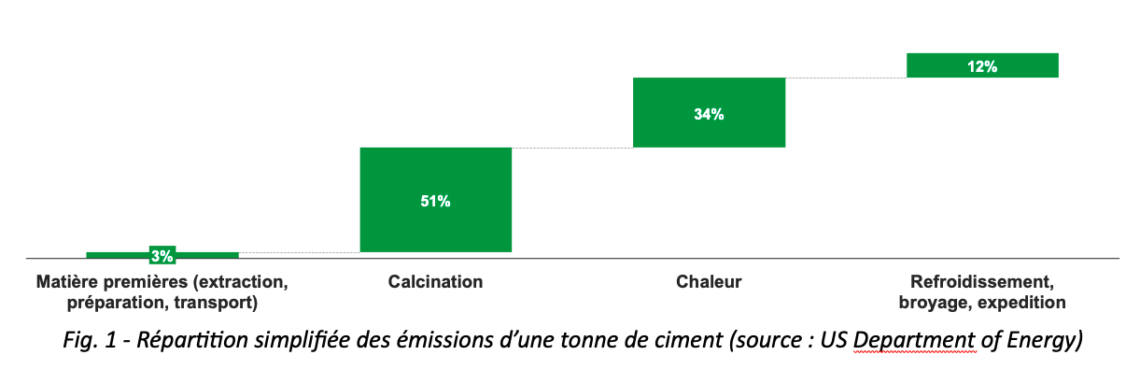

Around 85% of the industry’s emissions are related to the chemical reaction and the heat required for clinkerization, much of which is still heavily reliant on fossil fuels.

The type of cement produced, particularly its clinker content resulting from the calcination of limestone and aluminosilicates using various methods (wet, dry, semi-wet, or semi-dry), significantly influences the final emissions associated with the use of a tonne of concrete. However, the most carbon-intensive cements (CEM I and II) remain the best-selling types in France due to their mechanical properties, especially for structural projects, and their low cost.

Decarbonizing cement production is currently being considered by the industry and the government on four levels by 2050: reducing clinker content, improving energy efficiency of alternative fuels, and most importantly, carbon capture. These four strategies are relevant but each comes with significant limitations.

Substitutes for clinker enable the production of viable cements for structural concrete.

These substitutes consist of industrial by-products (such as blast furnace slag or fly ash) or processed natural materials (such as calcined clays, pozzolans, or crushed limestone). However, their availability is limited, particularly if confined to economically feasible distances for each cement plant, as cement is predominantly produced for local markets. For example, approximately 80% of blast furnace slag in France is already utilized for cement production, and the sustainability of steel plant sites is uncertain. Moreover, concretes using these substitutes exhibit characteristics that necessitate changes in construction norms and practices. For instance, concretes with lower clinker content may have reduced 28-day strength compared to high-clinker concretes, requiring adjustments in construction methods.

The energy efficiency of cement plants can still be enhanced.

In France, 50% of clinker production occurs in plants not utilizing the most optimal energy consumption techniques. The industry can upgrade kilns and improve the efficiency of other key components in the chain, particularly grinding processes. However, electrification of kilns—crucial in other industries—appears challenging in the short to medium term. Significant investments are required for these upgrades, such as €200 million to enhance the kiln at the Eqiom cement plant in Lumbres while increasing clinker production by 70%, or €285 million to replace two semi-dry lines with a precalciner dry line at the Heidelberg site in Airvault. Once modernized, however, these lines can only marginally limit emissions through this lever.

The use of alternative fuels is progressing, but projections rely on fragile assumptions.

It remains relatively low in France compared to, for example, Germany. Forty-four percent of energy used in cement production in France comes from waste, including 52% from biomass. The roadmap aims to transition to 85% and 60%, respectively, but several factors limit the likelihood of this transition. The volume of non-recyclable or unrecoverable waste is expected to decrease, and biomass is in high demand; 40% of final energy consumption in France will likely not be electrified by 2050, and biomass will be utilized by gas and synthetic fuel producers, as well as agriculture. Forests serve as a carbon sink that must be preserved, and the carbon neutrality of wood combustion is questioned, especially as water stress slows forest regeneration. Therefore, using wood as a construction material appears preferable. Additionally, other burned wastes are not carbon-neutral; for example, tires only save “only” 45% of greenhouse gas emissions compared to oil.

CO2 capture represents a distant, highly complex objective crucial to approximately 55% of envisaged efforts.

First, in addition to the process itself, the electricity consumption of CCUS (carbon capture, usage & storage) would be 0.7 TWh/year from 2030, and an additional 1.95 TWh/year by 2050 (equivalent to half of a 900MW nuclear reactor). Secondly, few industrial sites seem both technically, socially, and economically viable for capturing CO2: Dunkirk, Le Havre for offshore storage in the North Sea, and Lacq in Pyrénées-Atlantiques for storage in former gas fields—corresponding to the National Low-Carbon Strategy but involving only 5 cement plants in France. The cost of capture equipment and especially transportation and storage infrastructure is substantial. For instance, €150 million is required to capture CO2 at the Eqiom plant in Lumbres, and the question of transport (the Artagnan project) has yet to be resolved. The cost of pipelines would represent approximately an additional €200 million. All else being equal, CO2 capture could increase the cost of a ton of cement by €100.

Other innovations in carbon capture, such as Fastcarb (carbonation of recycled concrete aggregates), complement CCUS but are still in the experimental stage.

The necessary investments to modify processes and modernize cement plants will lead to price increases. While major construction groups can absorb these costs, they may be relatively minor in the overall cost of a typical single-family home; however, passing on these increases to consumers proves challenging for small and medium-sized enterprises (SMEs) already affected by inflation in other construction materials.

Beyond cement, changing the use of concrete and construction practices in France

To meet greenhouse gas reduction targets and comply with the 2020 Environmental Regulation, the above strategies may not suffice within the envisaged timeframe. Therefore, the industry will need to go beyond decarbonizing cement production in collaboration with its clients.

Considering not just cement but the entire cement-concrete industry, additional decarbonization strategies, with numerous possible configurations, will involve reducing cement content in concrete (aligned with low-clinker cement properties), modernizing procurement processes—voluntarily or mandated by regulations—incorporating CO2 objectives based on life cycle analyses at the functional unit scale, rather than mandatory use of low-carbon concretes. Additionally, concrete quantities used will decrease through new design and construction methods, better management of construction site losses, and primarily by utilizing other bio-sourced materials, notably wood.

Addressing emissions from the cement-concrete industry, essential for sustainability, also underscores reduced construction and renovation activities, which are central amid a shortage of new or renovated housing.

[1]ADEME, « Plan de Transition Sectoriel de l’industrie cimentière en France : Premiers résultats technico-économiques – Rapport de synthèse», 2021

[2] Entretiens avec des professionnels du secteur. Voir aussi Electrifier la chaleur industrielle pour décarboner, Colombus Consulting, 2022

[3] France Stratégie, Vers une planification de la filière bois, juillet 2023

[5] ADEME, Le captage et le stockage géologique de CO2 (CSC) en France, juillet 2020