India is entering a decisive phase in the evolution of its automotive sector. As the country edges

closer to the $4,000 GDP per capita threshold – projected between 2028 and 2030 – it stands on

the brink of a major motorization wave. This income milestone, identified by multiple studies,

has historically triggered exponential growth in car ownership in developing economies. India

appears poised to follow a similar trajectory.

1. Rising incomes fuel motorization

India’s automotive market is already demonstrating strong fundamentals. Passenger vehicle (PV) sales are expected to grow from 4.3 million units in FY2025 to 5.1-6 million by FY2030 (Moody’s, Markets & Markets). If India follows a similar S-curve to China, annual sales could rise to nearly 20 million by 2040, signifying an automotive revolution in scale and pace.

Yet the market remains dominated by two-wheelers (2Ws), with annual sales of approximately 19 million units, making India the largest 2W marjet in the world. This reflects not only their affordability but also the adaptability of 2Ws to urban congestion, limited parking, and cultural preference for agile personal transport. However, rising middle-class incomes, urbanization, and better credit access are tilting the equation in favor of four-wheelers, particularly in Tier 2 and Tier 3 cities.

2. A concentrated market driven by SUVs

India’s PV market is increasingly dominated by a small number of players. Maruti Suzuki, Hyundai, Tata Motors, Mahindra, and Toyota now control nearly 85% of total PV sales, giving them disproportionate influence over product strategies, emissions technologies, and feature adoption such as ADAS.

A major shift within this market is the rise of the SUV segment, which now accounts for over 50% of PV sales in FY2025, up from ~30% just five years ago. This shift is driven by aspirational consumers, improved road infrastructure, and growing demand for higher seating positions and road presence. Entry-level SUVs are replacing premium hatchbacks as first-time car buyers seek more utility and perceived safety. Meanwhile, OEMs are increasingly offering SUV variants across multiple price points, accelerating adoption across income segments.

Moreover, the domestic market is being reshaped by export ambitions: India is increasingly seen as a global manufacturing hub, especially for compact and sub-compact vehicles. Hyundai, Suzuki, and Kia are among the automakers scaling up exports from India to Latin America, Africa, and Southeast Asia, reinforcing India’s competitiveness in small car platforms.

India’s ascension to the third-largest car market globally (surpassing Japan in 2023, according to OICA) further underscores its strategic importance for global OEMs, many of whom are investing heavily in localization, EV capabilities, and export-oriented platforms.

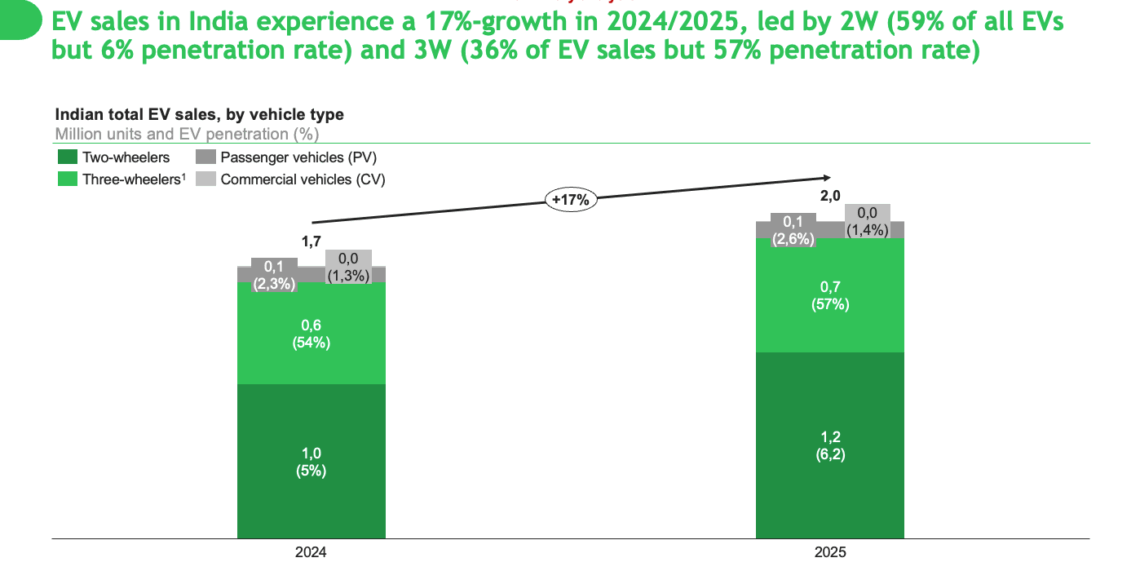

3. EV Momentum: Fastest in 3W, consolidating in 2W, emerging in PV

India’s electrification story is unique. Unlike many Western countries and China, where EV adoption is led by passenger cars, India’s EV transition is being driven primarily by electric three-wheelers (E3Ws). As of FY2025, E3Ws account for nearly 57% of new 3W sales, buoyed by the FAME II scheme, E-drive program, and favorable total cost of ownership (TCO) dynamics for commercial users. Battery-swapping, low-speed homologation, and localized assembly have further catalyzed the segment.

In the E2W segment, electric penetration stands at ~5–6% of all 2W sales, supported by a more concentrated group of players including Ola Electric, TVS, Ather, and Bajaj. These companies benefit from stronger brand awareness, access to capital, and vertically integrated supply chains. Market growth here is propelled by rising fuel costs, urban air quality concerns, and growing consumer comfort with EV reliability.

The passenger EV segment (E4W) is still in its early stages, with less than 3% penetration in FY2025, but poised for acceleration. Government policies like FAME II (with potential extensions under FAME III) and the PM e-Drive India schemes are providing vital capital subsidies and infrastructure support, where the middle class cannot for now purchase Evs without subsidies, unlike China. Tata Motors currently leads the PV EV market with the Nexon and Tiago EVs, while global players like Hyundai, MG, and BYD are entering the space with more premium offerings.

Conversely, the E3W market remains highly fragmented, populated by hundreds of small-scale assemblers offering price-sensitive products with minimal differentiation. While this fragmentation fosters affordability and regional customization, it also poses challenges for scaling quality, safety, and after-sales service.

Conclusion: A Transforming Market with Global Significance

India’s automotive landscape is undergoing structural change across all dimensions: income-driven motorization, OEM consolidation around the SUV format, and electrification anchored in commercial use cases. With the $4,000 GDP per capita milestone on the horizon and over 25 million annual vehicle sales (2W + 3W + 4W) already in motion, India is not just catching up – it is setting the template for automotive transformation in the Global South. For investors, suppliers, and OEMs, this means one thing: the opportunity cannot be seized from the outside. To capture growth, build relevance, and export new models to other emerging economies, companies must embed deeply in India’s ecosystem – by producing locally, co-developing with Indian partners, and investing in the supply chains that will define the next decade of mobility.